AAVE crypto review, is AAVE a good crypto?

Although it doesn’t rank in the top ten of Coinmarketcap, the AAVE crypto review is quite interesting to explore. Since January the increase in the AAVE value tends to form an ascending chart.

With the current price of $ 477.19 with a total market capitalization more than of 5 billion USD and the total circulating supply of tokens having reached 77%, AAVE has become one of the most important cryptocurrencies for many users.

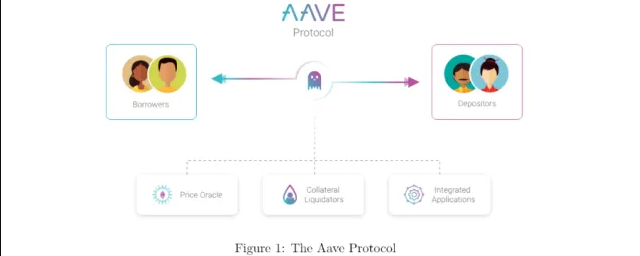

AAVE at a glance is the Defi (Decentralized Finance) protocol that allows users to borrow and lend crypto.

Best TenkoFX broker. Good forex Brokers with positive feedback of reviews from users and are regulated by IFSC Belize

Open an account or try a Demo account.

AAVE crypto explained

This crypto is a decentralized finance protocol (Defi). AAVE is an open-source and non-custodial protocol on the Ethereum smart contract blockchain. The AAVE protocol gives access to each user to lend and borrow digital assets, in this case, cryptocurrency.

AAVE was founded in September 2018 following the previous year’s successful initial coin offering (ICO) for its ETHLend token which raised USD $ 16.2 million.

The executive team under ETHLend migrated to Aave and ETHLend became Aave’s subsidiary.

In January 2020, ETHLend announced that they were no longer operating. However, the website will only remain active for current users to cover existing loans.

AAVE’s goal is to fill the gaps left by centralized fintech industry giants like PayPal, Skrill, and Coinbase.

Their main product is Aave Protocol, it is an open-source and non-custodial protocol for creating a money market on the Ethereum blockchain.

AAVE crypto definition

AAVE in Finnish means ghost. Initially, this was ETHlend which was launched in 2018 before changing to AAVE.

The biggest and most inseparable aspect of this project is the Aave Protocol launched in January 2020.

His shift from ETHLend marks a significant strategic shift for the Company. Which then changed the decentralized P2P lending model into a pool-based strategy.

What is AAVE protocol?

Aave Protocol is an open-source non-custodial protocol that allows users to create their own decentralized money market on the Ethereum blockchain.

AAVE crypto launch date

AAVE crypto launch date

Initially, AAVE was ETHlend which was operational when it was launched in 2018.

- 2020-01-08 Aave protocol has been launched on the Ethereum Mainnet.

- 2020-01-09 Aave Oracle Powered by Chainlink.

- 2020-03-26 BUSD is listed on Aave.

- 2020-05-28 Aave is listed on Uniswap Market.

AAVE crypto founder

Aave was founded by Stani Kulechov who also founded his predecessor ETHlend.

Aave was founded by Stani Kulechov who also founded his predecessor ETHlend.

Kulechov started programming when he was a teenager, and he is currently a businessman attending law school.

Aave’s target is a growing number of cryptocurrency users. Through Aave, he targets a wider range of users through the crypto community on the Ethereum network.

He is experienced as a spoken about fintech, especially for Ethereum smart contract networks.

He is from Helsinki, Southern Finland, Finland, which is why Aave takes words from Finnish.

How does AAVE crypto work?

The way Aave works is borrowers provides liquidity by depositing cryptocurrency into lending pools.

Then people who want to borrow can get a loan by utilizing the lending pool, either in a way that guarantees something or does not use collateral.

It does not require face-to-face meetings between the borrower and lender, because all of that is available in the lending pool that mediates between the two.

However, deposits into the lending pools and the amount borrowed/collateral are used to make instant loans based on pool status.

The depositors get interest by the deposit in the lending pool and the borrower pays interest according to the agreed rules.

Interest rate

The interest rate is determined based on the algorithm made in the Aave protocol.

For depositors, the amount of the interest rate that will be received is based on the value and amount of funds available in the loan pool at a certain time.

When borrowers start taking funds in the lending pool, the amount of available funds decreases which in turn will increase the interest rate. For lenders, the interest rate is adjusted according to the level of income.

The algorithm of Aave protocol maintaining liquidity reserve algorithm, it will guarantee any withdrawals. LEND tokens can be used to reduce transaction fees.

In the Aave protocol itself, the governance of the system operation can be regulated by those who hold the LEND token by voting to determine decisions related to protocol parameters and upgrades to the smart contract.

Loan Features at AAVE

Aave offers a flash loan feature that differentiates it from other loan patterns.

Flash loans allow customers to take out loans without collateral. Of course, this is quite interesting because most loans require collateral.

This allows customized smart contracts to borrow assets from the reserve pool in a single transaction.

Loans are made on the condition that liquidity is returned to the pool before the transaction ends.

However, if not paid off by then, the transaction will be canceled which will effectively cancel any action taken up to that point and ensure the safety of funds in the reserve pool.

The flash loans feature is designed for developers to get capital for arbitrage, refinancing, or liquidation purposes. The fee for a flash loan is 0.09%, this is a low fee.

Rate Switching

The rate switching feature allows borrowers to switch between fixed rates at a floating rate. This feature is especially useful in a volatile decentralized market.

For high-interest rates, users will usually choose a fixed interest rate, but when it is unstable, users may choose the floating option to reduce borrowing costs.

The fixed interest rate can be changed, only if the level of deposit income increases above the fixed loan rate because the system can become unstable by paying more than is paid.

If so, the fixed exchange rate is rebalanced back to the new stable rate. On the other hand, when the variable interest rate is lower than the fixed-rate by 20%.

The loan will automatically drop to account for the difference.

Token supporting

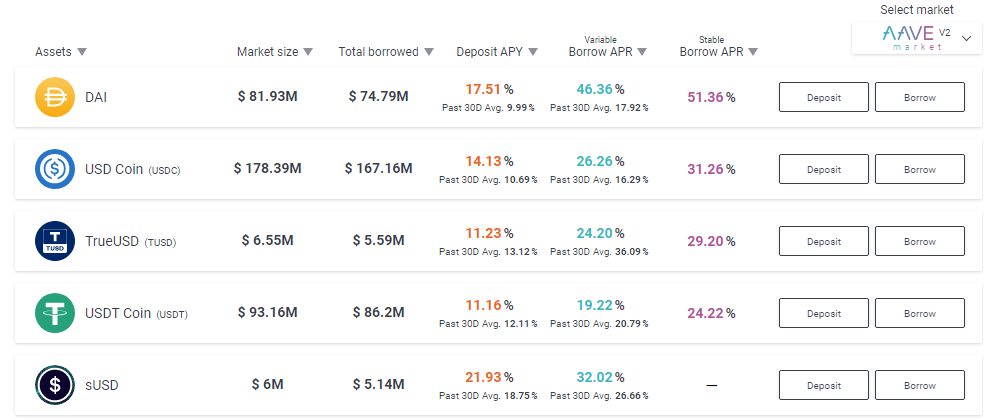

There are 19 tokens available in Aave which you can customize with the available options, some of them is DAI, USD Coin (USDC), TrueUSD (TUSD), USDT, sUSD, Binance USD, Ethereum, Basic Attention Token ( BAT).

Each asset has different collateral requirements due to differences in price volatility. Apart from these tokens, there is also a native token that Aave uses and is called Lend.

How to use AAVE crypto?

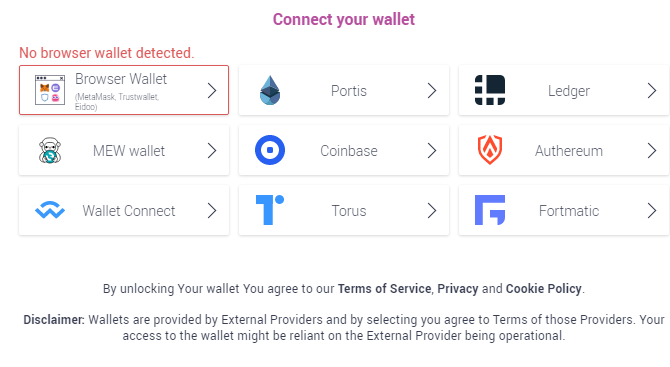

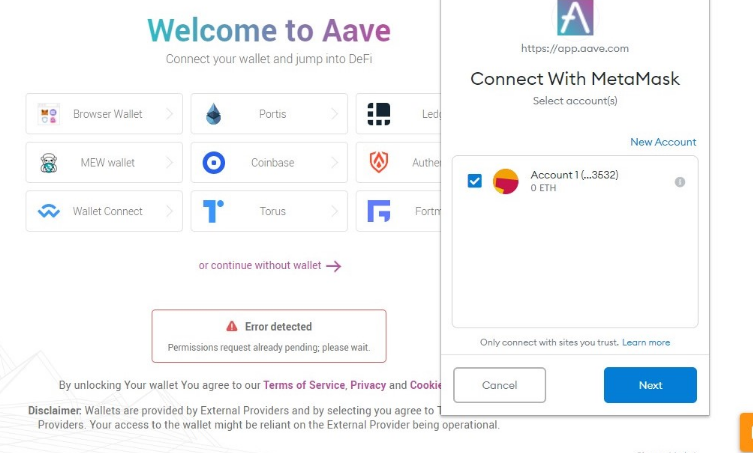

To use Aave for the purpose of borrowing or becoming a borrower, users must have a web wallet 3.0 which will be linked to the Aave service. There are several wallet options that can be used, Metamask, Portis, Coinbase, MEW wallet, Ledger, wallet connect, Torus, Authereum, or Fortmatic.

How to lending on the Aave platform

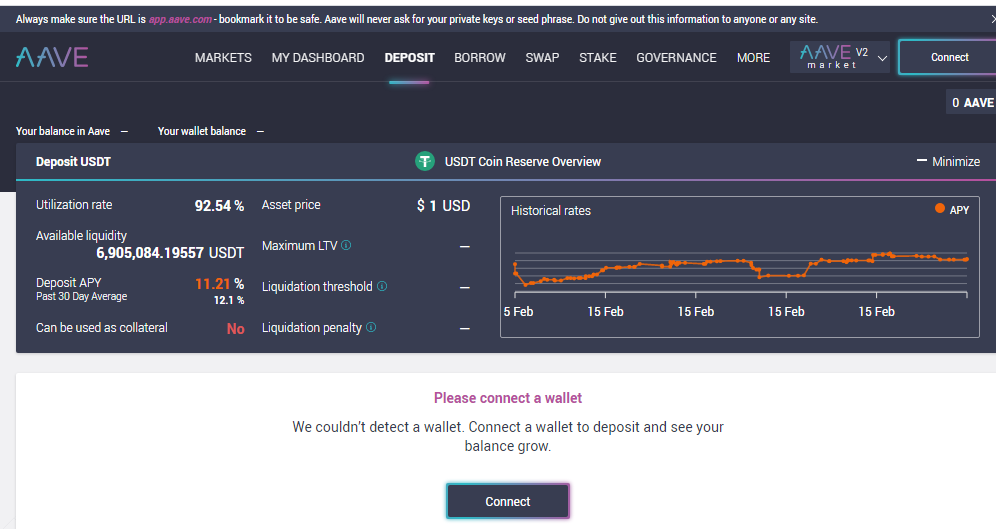

To lend you must have funds in a wallet that must be connected to Aave, go to https://app.aave.com/ then connect to your wallet before starting the next step.

Go to the Aave website

Scroll down and you will find a list of supported cryptocurrencies, and you only need to choose which token to lend.

For example, you choose a USDT token then click “Deposit” which will then be directed to the next step.

Connect to web 3.0 wallet, for example, you use Metamask, by clicking Metamask browser wallet then you will be directed to the next step. If you don’t have a Metamask wallet, it is not detected and you can choose other wallet options available.

Once you have successfully connected your wallet with the Aave platform, you can immediately make a deposit with the next easy steps.

And you need to know is that the interest rate is not static, but will depend on market conditions for the token demand.

How to borrow on Aave?

The steps for borrowing crypto tokens are also quite easy and as for deposit funds

Visit Aave website

On that page, scroll down and select the token to borrow. Say you chose USDT, simply click “borrow” and you will be presented with a form that contains details on the interest rate and so on.

The next step is connecting with your wallet to get loan funds.

Where to buy AAVE crypto?

For buying and selling Aave tokens, there are several well-known exchangers that provide Aave tokens.

You can buy Aave via Coinbase, Kraken, or Gemini, or in Binance.

How to buy AAVE cryptocurrency?

The first step is to register with an exchange where you will choose to buy Aave through their platform.

Next is to verify your account to be able to use the exchange platform more freely.

Purchasing requires funds, so you need to deposit a certain amount to start buying Aave crypto. Do it according to the steps required in the available payment options.

If funds are available you can immediately buy Aave crypto with easy steps with available funds.

AAVE crypto price history

Since October 2020 Aave’s price has ranged between $ 53 and a low of $ 26 through November 2020. The price is gradually increasing to $ 111 in January 2021.

The price then continued its upward movement with larger volume and reached an all-time high of $ 559.12 on February 10, 2021.

Aave’s current value is at $ 476.44, the price tends to decrease on daily volume. However, the decline that occurred still allows for an increase, because market demand is expected to increase during the pandemic.

AAVE crypto prediction

With a market capitalization of more than 5 billion dollars, Aave is the second biggest Defi project, with a large increase in liquidity in early 2021.

Various predictions predict future Aave prices may increase, along with demand. Here some predictions from several well-known forecasting websites.

Investingcube

Investingcube predicts that Aave price may reach $ 600 in the near term in 2021, this is supported by the 25 EMA of the indicator forming an ascending trendline.

Digitalcoinprice

Digitalcoinprice even predicts Aave’s price in 2021 to reach $ 693.72, and there will be a gradual increase in price until 2028 can reach $ 2,165.54.

Wallet investor

Wallet investor, which is a popular forecasting site, is higher on Aave’s forecast this year to reach $ 1468,780. Even higher the prediction for the next five years in 2025 to reach $ 5612,710.

Long forecast

The long forecast predicts Aave’s price to increase gradually from January to December 2021 with a high of between $ 928- $ 115. However, the forecast for 2024 is seeing a gradual decline and bottoming out in March 2025 at $ 295- $ 377.

Gov capital

Gov Capital predicts Aave’s price this year to reach $ 1116.520954, up more than 100% from the current price. But the surprising prediction is that prices will fall to a low of $ 84 in January 2022. Before finally climbing even higher at $ 1060 in late December 2022.

Is AAVE crypto a good investment?

Aave is a Defi project that provides services to borrowers and borrowers of crypto tokens. I think that the volume of demand for this service will increase due to the convenience it offers.

Moreover, this platform can reach all over the world, thus allowing the increase in demand to be even greater.

However, this service must be accompanied by strong security, because wherever there is large money, it will be vulnerable to security problems.

Once facing a security problem, it can make the platform decrease in value and decrease its users.

But behind the pessimism about the future Aave value, in many conditions, when a price moves up sharply, it is out of the ordinary, this indicates extraordinary demand and has the potential to become high risk when the price has entered overbought.

Conclusion

Aave crypto is a lending platform that is different from conventional models.

Because it uses a certain algorithm that will work automatically, here the advantages of the Aave platform are one step better than conventional models.

Even more interesting is the feature of borrowing without collateral. This could be the reason why it is important to use Aave.

Ready forex, crypto trading? Open an account or try a Demo account.

Browse more article