Forex trading money management strategies

Forex trading money management strategies, although sometimes this is quite confusing and boring, this is a very important lesson in trading on the financial markets.

Try comparing two beginner traders with professionals, when tested using the same amount of money, the same strategy, but the end result will be different.

Beginner traders will lose money and even stop out the account, but professional traders can gradually increase their total money.

What is the reason for the difference in results? Forex trading money management strategies.

This is a very important lesson if you want to become a profitable trader.

Maybe implementing money management is not fun because traders must always monitor their total loss in every trading action.

But indeed that is so, sometimes the medicine tastes bitter but taking medicine can cure a disease.

Start trade with TenkoFX broker.

One of forex Brokers with positive feedback of reviews from users and are regulated by IFSC BelizeOpen an account or try Demo account.

What is Forex money management?

Money management strategies are a way to minimize risk to increase profits.

This is a rule in a trading plan by applying strict risk rules.

Understanding the basic concepts of money management is easy enough to understand for beginners.

But in practice, there are still many beginners who feel bored by applying this.

Because of the mindset of wanting to quickly make a profit in a short time.

This is the biggest obstacle to applying money management in a disciplined manner.

If two traders use $ 100 and one trader uses a strategy with 80% winning trades but he does not apply disciplined money management rules.

And one other trader uses a strategy with winning trades only 50% but he applies money management strictly.

So even though the first trader has good trading strategy skills, he will fail, and other traders who apply strict and disciplined money management rules will be able to survive and be more profitable.

Why forex money management is important?

When a trader opens a position and plans a 10% risk, if he gets a loss, to recover the total loss only requires 11% profit.

But if a trader dares to take a 50% risk then if he gets a loss, it requires 100% profit to be able to return the funds to the initial amount.

The higher the risk is taken, the higher the percentage of profit to return the funds to the initial amount. And of course, this is not easy and will feel very boring if it already has a big total loss.

So this is the importance of implementing money management strategies to be able to increase opportunities when a trading plan fails.

Take a look at the table image below to get more understanding.

From the table above, we clearly know that the higher the risk, the more difficult it is to recover the loss.

Imagine if we take a 90% risk, it requires a 1000% profit to recover the initial capital amount.

Even to get a profit of 10% per month will be difficult, especially if you have to get a profit of 1000%.

So this is where the importance of forex money management strategies.

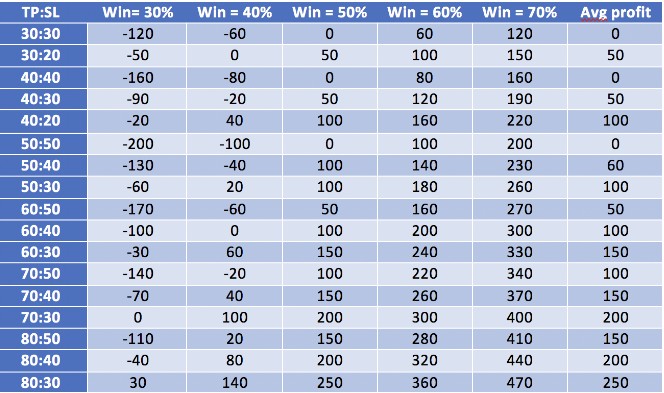

Maybe the picture above still does not provide a detailed explanation, now look at the table below.

From the table above we get a detailed overview.

Which is applying money management uses a risk-reward ratio and also looks at how good the trading strategy is to get higher winning trades.

The more stringent the risk-reward ratio or target profit and stop-loss are. The better the performance of our account even if it only has a low percentage of winning trades.

The example above shows if we use stop loss 80 and profit target 30. Even though we only have 30% winning trades, but we have already gotten 30 pips profit.

Calculate your trading win rate

Being a meticulous trader requires trading notes or more commonly known as a trading journal.

By writing trading notes in this trade journal it will be easier to calculate the number of your winning trades.

This will help you evaluate your trading strategy working well or poorly. So that in the future you become more alert when opening new transactions.

However it will be very difficult to always profit, and the risk-reward ratio here is one way to manage risk, and this is the next puzzle.

When you set a target of 80 pips and stop loss of 30 pips, twice the loss will still be covered by one winning trades.

But the problem is when the profit target is too high, this allows the price to hit stop loss first before reaching the target.

Even in annoying conditions, only a few pips to the target but it is not achieved because the trend has changed.

Then you also have to pay attention to determine the ideal target so that more winning trades will you get.

Learn hard to apply money management strategies

To avoid bad luck in trading is to control through stop losses. Some experts suggest, never risk more than 1% of the total equity in any trade.

And this way is a very good approach.

So even though a trader gets 20 consecutive mistakes but still has the remaining 80% of his equity.

But indeed very few traders have the discipline to practice this method consistently. This is needed very hard work and requires a strong mentality.

But most traders can absorb risk discipline lessons through bad experiences of losing money. Then that is the main reason for traders to use a capital for speculation in forex trading.

And when beginners ask how much money to start trading, experienced traders say:

Use the money that does not materially affect your life if you really lose it.

This is also a very wise suggestion, and feasible for anyone when he considers entering the forex trade.

How to trade money management strategies

In applying how to use forex money management strategies there are two important things that need to be a trader ‘s attention.

- Risk per trade.

- Risk reward ratio.

#Risk per trade

In every trade action the trader must pay attention to risk per trade, this refers to the maximum total risk to be taken per every single trade.

Usually, traders use a percentage of the size of the trading account to determine risk per trade.

Let start with a simple example, you have a balance of $ 10,000.

Then in one trade, you risk $ 2,000 loss (this maximum loss if the order reaches a stop-loss), then your risk per trade will be equal to 20%.

But taking 20% risk per trade is too risky because if you get five times a loss in a row it will remove all your money.

Even if you get a loss twice, it will make your remaining 60% money, and you have to fight to do recovery.

You need more than 40% to get back your initial account balance of $ 10,000.

You can read back to the table above to get an idea of how risk per trade is important to understand.

#Risk-reward ratio

The next way to implement money management strategies is to pay attention to the risk-reward ratio, this is also an important concept in money management.

The risk-reward ratio refers to your maximum total loss on a trade and your maximum profit on a trade.

To decide the risk the trader usually determines the stop-loss level and to decide the profit the trader usually sets the take-profit level.

Simply put, for example, you take a risk of $ 100, and your maximum profit is $ 100, this means you specify a stop-loss equal to take profit minus the cost of the spread.

The risk-reward ratio above is 1: 1 but, if your maximum loss is $ 100, and your maximum profit is $ 300, your risk-reward ratio will now be 1: 3.

The advantage of using the risk-reward ratio

A survey conducted by a broker has been shared through a community forum, they gather traders who use a risk-reward ratio above 1: 1, say 1: 2 this is more profitable even though the win ratio is only 30%.

According to the survey results that the best risk-reward trade ratio is 1: 2.

How do you explain it? Let say you opened six trades, each with a risk-reward ratio of 1: 1.

If from the six trades you get three winning trades and three losing trades, then you make $ 0. You will still break even.

However, if you use a risk-reward ratio of 1: 2 with the same financial assumptions per trade.

Three losing trades and three wins hence you still get a profit because of your win twice profit more than as on each trade that wins compared to your loss on each lost trade.

And this is the advantage to use a risk-reward ratio in a complete money management system.

Best tips for improving money management strategies

Money management is a supporting tool in forex trading, but the real weapon is the skill in trading because if you keep getting lost, little by little the funds will run out too.

The tips below are the best for improving the quality of your trading skills.

Don’t chase market prices

The mistake most beginners make is chasing prices in the market and getting prices with low probability.

This condition often occurs when price action moves volatile, for fear of losing momentum.

Then with a market order opening a position even though he gets a price that has moved far.

Usually, after an order is opened he will be dragged and get a floating loss.

For fear that sometimes they rush to close a position and this will only disrupt trading methods.

Traders should wait for prices to bounce before opening positions when the trend has run away.

Remember a quote,” don’t catch a flying knife, you will bleed, but wait for the knife to fall and bounce it will lower the risk”.

Cut your loss early and let your profit run

Another mistake that beginners often make is, too fast close profit is only a few pips. But let the floating loss only by expecting prices to back to the initial track.

Maybe some of you don’t use risk-reward ratio with stop loss and profit target and rely on your analytical skills.

When it comes to the point where your analysis is wrong, a faster cut loss will be better than leaving it in uncertainty.

And when your direction is right, the trend is moving well, letting profit run is the best way to maximize profit, you can modify the stop loss at the break-even point for this method.

But you don’t have to always use this method, because not all trends will move strongly.

Wise in using leverage

Leverage is a double-edged sword, maybe the broker you choose offers leverage of up to 1: 1000 or higher.

It’s tempting, with a small fund the opportunity to trade the same as a large fund, if lucky the profit will be large.

But high leverage without good emotional greed control, then this backfires, so money quickly stops out by price fluctuations.

The ideal leverage for a retail trader is 1: 100, this will prevent overtrading and if the margin call is not all funds will be lost.

Final thought

Money management strategies for traders are very important in implementing daily trading.

Forex trading is not an easy way to get profits without having experience and a good understanding.

Many traders are sometimes working in gambling in forex trading because they only rely on luck.

If you follow the advice of professional traders, take only 1% of your total equity, this is crazy because it is very strict in risk management.

But you will get many opportunities to try again.

Thank you for reading, may you share this.

Open an account or try Demo account.

Related article

Fundamental analysis vs technical analysis

Central bank main functions, most central bank impacted market