Financial bubbles in history

For investors, paying attention to financial bubbles is very important to pay attention to, because in the history of financial bubbles, they can cause huge losses. Even the impact can be global in scale.

In its history, there have been several times the economic bubble phenomenon, one of which is the famous tulip flower phenomenon that occurred in 1637, which is known as “The tulip mania.”

During its development, there have been many studies on the economic causes of bubbles about what causes this phenomenon.

Best TenkoFX broker. Good forex Brokers with positive feedback of reviews from users and are regulated by IFSC Belize

Open an account or try a Demo account.

Financial bubbles definition

An economic bubble is an economic condition marked by an unrealistic and unsustainable increase in asset prices.

This period was marked by irrational expectations and wild and out of control speculation.

The prices of securities and other assets have risen significantly, which, when they have exploded, can cause a severe economic collapse.

Like a bubble, the value of an object that has increased fast enough over time will ‘burst’. This means that prices that were high enough at some point will fall very low. An economic bubble is not a good sign. This causes huge losses, especially for the macroeconomy.

Some bubbles occur naturally as part of economic cycles, some also occur as a result of investor neglect and serve as corrections.

This usually occurs in securities, the stock market, real estate, and various other business sectors due to changes in the key players in doing their business. This then results in a bubble that can have a significant economic impact.

How do financial bubbles work

An economic bubble can occur whenever an asset has an increase in price than the price it should be, this usually occurs due to changes in the behavior of investors in valuing the asset.

Broadly speaking, the economic bubble event can occur through four processes.

Trigger

In the initial process the trigger that is most likely to cause an economic bubble will emerge. The most common trigger is excitement.

Maybe you still remember about Bitcoin. Yes, at that time many people started chasing Bitcoin because its value was getting higher and higher day over day. Investors are excited about the thought of owning a higher value Bitcoin than when they bought it.

After the Bitcoin price jumped high, then a bubble burst. The falling price is so low that investors have to face the harsh reality that the value of their investment is falling rapidly.

In the trigger stage, usually, the first investor gets a low price, so that as the price increases, other investors will then follow to buy the asset.

Awareness

In this second stage, new investors will realize that the price of these assets is increasing significantly. This condition causes these investors to follow market trends by the act to buy an asset, the more investors buying an asset, the higher the value of the asset.

Many investors speculate when the price trend increases significantly.

Booming

More and more investors are busy talking about assets and buying without analyzing at the current price. Their only hope is that there will be other investors who will push the price even higher in the future.

During boom times, the smart first investors will usually sell the asset, and they get rich by a large increase in price from their original value when they bought it.

Burst/crashing

Imagine a bubble of soapy water flying through the air. Over time the water will fade and bubbles burst.

When the first investors started selling the asset, it gradually became a sign that something was going to happen with the current price.

It was when the bubble burst that most investors just realized that many began to sell assets together, no matter what day and time it was bought.

There was a very rapid decline in prices and, as usual, prices actually fell further. That’s when many investors will lose money.

Many may have warned about bubbles burst that can appear suddenly. But investors may prefer to join the party, or it may be difficult to stop it.

Why do financial bubbles burst

Financial bubbles are not something new in the financial world, there has been a lot of history in the occurrence of financial bubbles.

Basically, investors who buy an asset in trending time with a price that has increased significantly, most do not do in-depth analysis. And tend to speculate.

However, what they do tends to follow a trend that they think prices will continue to rise. If investors buy an asset at the current price, their hope is to make a profit when more and more investors buy the asset in the future.

Maybe this is a bit similar to a Ponzi scheme, only the difference is that this Ponzi scheme is really a fraud. Meanwhile, bubbles are the excitement of investors who are excited to buy trending assets.

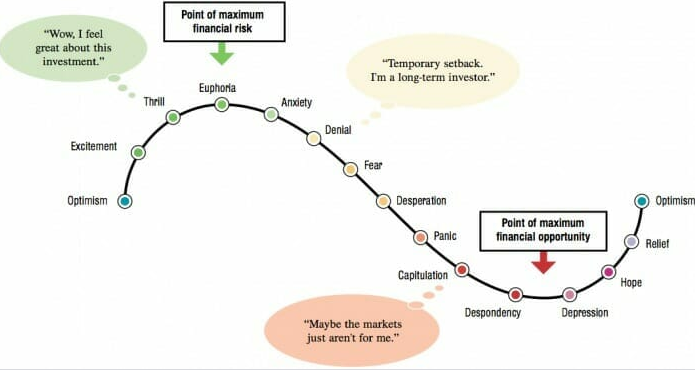

Panic, anxiety cause bubbles to burst

If in a Ponzi scheme the new investor will pay the old investor, and there will be a condition where there are no more new investors, then the scheme will break and there will be no more new funds to pay for the previous investor.

The economic bubble will also occur when the price will be at its highest. So that when the previous investors start selling their assets it will push the price down.

The euphoria has ended and the new investor panic will cause them to also sell assets due to their anxiety that the price has reached a high point.

They did this action because they didn’t want to suffer greater losses, and as a result, the price dropped drastically.

If in a Ponzi scheme the new investors suffer losses, as well as in the bubbles burst, the new investors may also suffer losses, if they don’t sell the asset immediately.

What causes financial bubbles

Various theories about the causes of financial bubbles depend on which asset becomes a commodity causing the financial bubble to rise.

Psychologically, what causes an increase in the price of an asset is the desire to buy an asset or commodity because it expects its value to always increase in the future.

This opinion was by Robert in 2008 who analyzed the increase in house prices because many people think house prices will never fall, and if they don’t buy now they will lose the opportunity to get a low price.

If grouped, there are five reasons for the occurrence of financial bubbles.

- Expansive monetary policy.

- Easiness to get Lending.

- Speculative behavior of investors.

- Excessive consumer optimism.

- Loose regulations.

Expansive monetary policy

This policy is to encourage production by increasing the money supply with a loose interest rate policy to stimulate the business world to produce higher.

With an injection of money, it can stimulate public spending so that demand increases and the company will increase its production by adding overtime hours and even new employees.

Easiness to get Lending

Low loan interest rates tend to increase the money supply, because of the public’s interest in borrowing money with the convenience offered.

With a lot of money in their hands, it can cause them to buy an asset that is considered profitable for the future. This can encourage an asset that is trending to increase in value.

Speculative investors act

Investor behavior can also cause a commodity to rise significantly. As the news has recently been in the spotlight, the Wallstreetbets community simultaneously bought Gamestop shares which caused the stock price to rise beyond the price itself.

Excessive consumer optimism

The attitude of excessive optimism by consumers makes them ignore the risks that can occur. For example, the tulip flower phenomenon is considered to be very expensive because of its popularity. Consumer optimism causes prices to rise significantly.

Loose regulations

Although it is not a significant cause, in one theory, loose policies can cause financial bubbles, due to the ease of buying commodities that are trending in the market.

Biggest asset bubbles in history

In its history, the financial bubble has occurred centuries ago. Among the most famous biggest asset bubbles in history are as follows:

- Tulip Mania at 1637.

- South sea at 1720.

- Wallstreet crash of 1929.

- Japan at 1989.

- Dotcom at 2000.

- US Housing at 2007.

- Bitcoin at 2017.

Tulipmania at Dutch

Tulip is one of the charming flowers which is one of the pride of the Netherlands flowers. Tulips became a luxury item and were sought after by the aristocracy. So traders who get tubers and seeds from tulips from Spanish sailors are increasingly buying the seeds and planting them on their land. Traders could see how potential tulips were if they were sold at high prices.

At that time people saw tulips as a symbol of social status, so many people were willing to pay a high price to get them.

The price of a tulip seedling can be the equivalent of a luxurious house complete with an 80ft tall garden.

In 1637 there was a drastic decline in the sale of Tulip bulbs until they stopped starting from the Haarlem area and then continued to other areas.

South sea bubbles

In 1720, the British financial sector entered a period of collapse. Government departments self-regulate their loans with minimal oversight of spending. Finally, the then UK Finance Minister, Robert Harley, convinced Parliament to straighten out this mess.

One of the first steps to take was to reconsider the commitments that would allow the Bank of England to be the sole regulator of sovereign loans.

One of the first steps to take was to reconsider the commitments that would allow the Bank of England to be the sole regulator of sovereign loans.

Wallstreet crash

The Wall Street Stock Exchange, United States, collapsed economically on August 24, 1929. Four days later, the London Stock Exchange experienced a major slump. The sudden fall in stock prices made millions of dollars disappear in an instant. In English, this event is called “The Wall Street Crash of 1929”.

Because the prices of the leading stocks fell by less than a third, many Americans lose all their savings in just a few days. This incident then became the beginning of “the great depression or “era of malaise” which practically affected the whole world. The collapse was one of the biggest exchange crash events in American history.

Japan bubble

In the Japan bubble event, when interest rates rose in 1989-1990 and the economy slowed down, investors finally believed that Japan’s economic growth was unrealistic. As a result, Japanese asset prices collapsed. For example, the Nikkei 225 stock market index, which stood at 38,915 in 1989, fell to 7,972 at the end of March 2003.

Falling asset prices caused household wealth to decline dramatically. Consumer confidence fell sharply and consumption growth slowed. Furthermore, corporate capital investment also fell, while bank lending contracted sharply due to the weak economy.

Dotcom bubble

The Dotcom Bubble is a speculation bubble that occurred between 1998-2000 when stock exchanges in industrialized countries experienced a sharp increase in equity value thanks to the growing industrial sector of the Internet and related fields.

The Dotcom Bubble is an internet bubble, a rapid rise in the valuation of US tech equities that was fueled by investments in internet-based companies during the bull market in the late 1990s.

During the Dotcom Bubble, the market value of equities grew exponentially, with the tech-dominated Nasdaq index rising from under 1,000 to over 5,000 between 1995 and 2000. In 2001 and until 2002, the bubble burst, with equities entering a bear market.

US housing

The crisis that occurred in America in 2008 was the beginning of the collapse of the oldest and largest investment bank in America, namely Lehman Brothers Bank.

At that time Richard Severin Fuld was the person who occupied the chair of the CEO of the oldest bank. At that time Lehman Brothers decided to borrow money from the Federal Reserve (here Bank Indonesia) in a very large amount. The loan amount is bigger than the investment bank in general.

Bitcoin bubble

Since the beginning of 2017 Bitcoin has become an asset that is in great demand, so the price has increased gradually because of the large public buy BTC.

Actually, many analysts have warned that there is a possibility of a bubble burst. And many people do not heed these suggestions. Sure enough, the Bitcoin price broke and fell to a low level.

How to detect financial bubbles

Financial bubbles usually occur because of positive sentiment that makes investors buy or take action simultaneously and continuously.

This condition caused a stir in the public views. So that the price which should have been in standard value had increased radically.

As in the tulip bubbles, the positive sentiment of the community causes traders to hoard tulip bulbs in large quantities.

This condition caused supply to increase sharply, while buyers began to decline. Because it took too long not to have many new buyers, traders are mostly stocking goods, so they are fear tulip will be damaged.

This condition causes the traders to start lowering the selling price, and simultaneously the price drops dramatically.

The influence of an important figure in society can also trigger a financial bubble. For example, Elon Musk’s tweet in favor of Dogecoin has caused crypto assets to skyrocket as market sentiment shapes the opinion that Elon Musk supports Dogecoin.

How to avoid financial bubbles

Financial bubbles can occur in all lines of investment. The role of the media which massively reports on a condition that cannot be controlled can trigger an asset to bubble up. Government policies that are expected to boost the economy sometimes have the impact of high inflation.

The reduction in interest rates on a low basis point is expected to provide public sentiment for getting loans. However, if the production machine remains the same, there is no increase, then it is possible that this condition will cause high inflation.

Citing from Forbes, some tips that can save you investing bubbles are as follows:

- Don’t mind you missing the party. Euphoria on an investment that is trending news sometimes causes investors to forget about risks and not want to miss a party. Don’t do it.

- Focus on your goal. Focus on your investment, don’t be tempted by other people’s games. This can prevent you from following the crowd.

- Diversification. This is the basic investment, with investment diversification, you are not like putting eggs in one basket. If it breaks there is another hope.

- Use discipline to sell. If you buy something, and see a favorable price, resell it because you’ve made a profit, don’t hold back just because it’s more popular.

- Rebalance. You can use both diversification and resell tactics. When an asset goes up madly, go back to your mixed plan so that it doesn’t get hit if a bubble bursts.

Final thought

Financial bubbles are a phenomenon that often occurs under various conditions. As a smart investor, he will invest according to his portion and will not be affected by the crowd. This is because once a bubble burst occurs, it can cause large losses in investment.

Ready to Trading fx, crypto?

Open an account or try a Demo account.

Read more article