Bitcoin vs USD

Bitcoin vs USD, which one is best? The emergence of Bitcoin can be a rival to the USD. Bitcoin as a cryptographic currency is considered by some experts that its existence is an alternative to the fiat currency that is currently commonly used.

The value of Bitcoin at the end of 2017 experienced a very drastic increase and had made several people rich. Bitcoin is claimed to be better and inflation resistant because it is designed with a limited number.

However, the USD which is the American currency is still widely used as a reference in international trade. So that the prestige of this currency has been accepted by many countries.

Then how is the development of Bitcoin at this time? can it shift USD or other currencies?

![]() Best TenkoFX broker.

Best TenkoFX broker.

Good forex Brokers with positive feedback of reviews from users and are regulated by IFSC Belize

Open an account or try Demo account.

#Bitcoin cryptocurrency overview

Bitcoin cryptocurrency is a digital currency that was first created by a person under the pseudonym Satoshi Nakamoto.

Bitcoin can be used to transfer money, without having to go through intermediaries, at a lower cost when compared to flat currency transfers through banks, or intermediaries.

Therefore, some say with Bitcoin you have your own bank. This makes Bitcoin increasingly popular, and many are fond of Bitcoin.

A summary of the advantages of Bitcoin is as follows.

Decentralized

Bitcoin is a currency whose circulation is not regulated by any central bank. Thus, no single traffic can interfere with the price. Although not officially regulated, the creation of Bitcoin adheres to a 4-year standard to ensure that the supply does not exceed 21 million.

Bitcoin will also not be affected by political issues like conventional currencies. As is well known, the value of the US Dollar always has the risk of being dragged into political issues that threaten the stability of the United States government. Given that Bitcoin is circulating without any government regulation, the same thing will certainly not happen to Bitcoin.

Low transfer fees and no storage fees

That’s because, Bitcoin is an open-source technology that everyone can enjoy, no matter who they are and where they are.

On the other hand, conventional currencies such as the US Dollar are strictly regulated by financial institutions which often charge transfer fees to their clients.

Unlimited Transactions

Because Bitcoin has no intermediaries, transactions can be carried out without any limits. Compare it with financial transactions that are usually facilitated by banks, credit card companies, or e-payment systems such as PayPal.

There are always minimum and maximum transaction limits imposed by such intermediary bodies. Apart from the amount, the transaction limit is also set for certain periods, such as a maximum of $ 5,000 in a day, $ 10,000 per month, etc.

Faster Transactions

When a wire transfer takes days to complete the transaction process, Bitcoin only takes about 10 minutes. The characteristics of Bitcoin as a digital currency are what make this possible.

More durable

Bitcoin does not circulate as paper money or even coins. The shape is untouchable because Bitcoin is a digital currency.

On the other hand, the conventional currency is easily damaged because most of it is in the form of banknotes. In some countries, the money has lost its value, aka no longer valid if the damage is too severe.

USD flat currency Overview

The US Dollar was founded in 1913 when the Fed or “Federal Reserve Bank” was first established. The goal was to reduce the uncertainty and instability of the currencies issued by banks at that time.

In 1944, delegates from 44 allied countries met in Bretton Woods, the United States of America to discuss ways to create a currency exchange system that could give a benefit to all countries.

Finally, all countries agreed that the world’s currency cannot be guaranteed by gold. However, it will be juxtaposed with the US dollar which is still guaranteed gold.

An agreement was reached that the central bank would fix the exchange rate of each currency in comparison to the US dollar. The United States guarantees that US dollars can be exchanged for gold on demand.

The US dollar is the world currency is officially secured by the largest gold reserves in the world. Other countries no longer use gold as collateral for their currency but accumulate US dollars as a substitute.

The use of the US dollar as a means of hedging was getting bigger, so even though President Nixon in the 1970s no longer guaranteed the US dollar with gold. The role of the US dollar as a means of hedge and world currency has not diminished till today.

Bitcoin vs USD Correlation

Bitcoin which is a digital currency in Intermarket analysis can correlate with other assets, for example by comparing Bitcoin to stocks, or Bitcoin with USD.

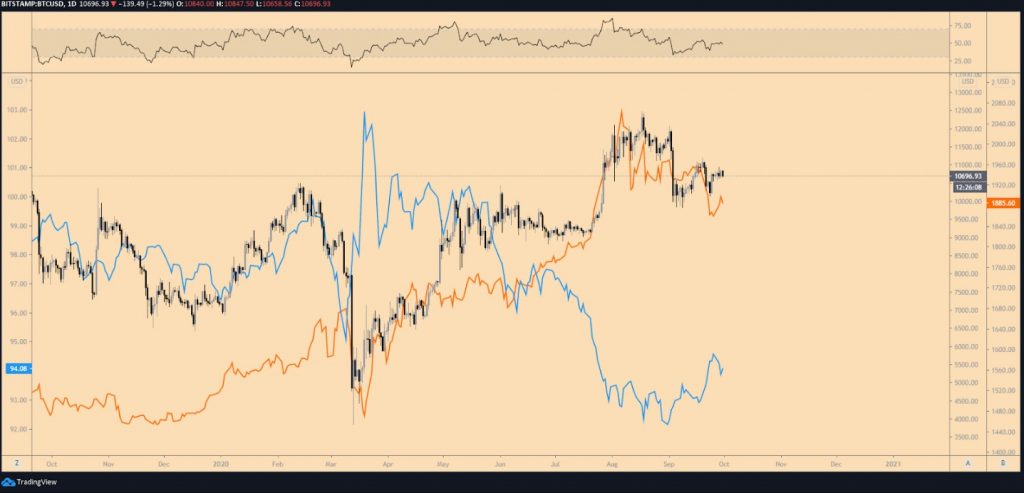

About the correlation between Bitcoin and USD, we can see how the historical charts behave in the two instruments.

For Bitcoin which facilitates analysis by pairing Bitcoin with USD as a price history data chart.

Meanwhile, for USD I will take data from the USD or DXY Index. The USD Index is a measure of the strength of the USD or tracking the strength of the USD by taking data with other currencies. The currency is the :

- Euro (EUR) 57.6% share

- Japanese Yen (JPY) 13.6% share

- Pound sterling (GBP) 11.9% share

- Canadian Dollar (CAD) 9.1% share

- Swedish krona (SEK) 4.2% share

- Swiss franc (CHF) 3.6% share.

From this average, it is then displayed in a chart whose value goes up and down depending on the strength of the USD currency.

Correlation Bitcoin vs USD

Bitcoin appeared in 2009 while the DXY formed by the Fed has been around since 1973 to measure the strength of the USD in the analysis of the American economy.

So the two graphs give different behavior, but measurement started since Bitcoin appeared in 2009.

The results of the correlation analysis between Bitcoin VS USD show that when the Dollar Index goes up, what happens with Bitcoin tends to decline, while when the USD Index goes down the tendency is for Bitcoin to rise.

The correlation begins with price analysis in 2017 when at the end of the year Bitcoin moved up significantly but DXY actually showed a decline in value.

Negative correlation often occurs between Bitcoin and the USD Index, although in random changes, it is clear that when Bitcoin goes up significantly, the USD Index falls as it happens today. DXY’s value is decreasing while BTCUSD is rising strongly.

This means that Bitcoin shows a stronger value than USD because there is no inflation, but instead increases in value over time.

Then why did the USD Index decrease but Bitcoin went up? This is indeed such a market mechanism, but in plain view that the rise of Bitcoin in the midst of a pandemic that has not ended is an indication that investors are trying to choose this digital asset for the long term.

They are not inclined to choose USD because it is still considered vulnerable to inflation and political turmoil that may arise after the election.

Bitcoin vs USD vs Gold

`The picture above shows the three instruments of Gold, Bitcoin, and DXY. The blue color represents DXY, the black represents Bitcoin and the orange represents gold.

We saw that in March when the market crashed due to the pandemic, the value of the DXY rose drastically, while Bitcoin and gold fell rapidly.

But slowly after the DXY decreased, Bitcoin and gold moved up, this still doesn’t break that gold is still negatively correlated with the USD.

While the correlation between gold and Bitcoin is positive because when the value of Bitcoin goes up, the price of gold also rises. However, it seems that the demand for gold is still inferior to Bitcoin because there was an increase in Bitcoin reaching 185% while gold was only around 31%.

This means that even though gold is a haven asset, most investors are starting to see Bitcoin as another alternative as a safe heaven.

One of the reasons that it will be that Bitcoin is designed with a limited total. There is no addition of any new Bitcoin once all is mined and in circulation.

The Bitcoin halving event a few months ago was also the reason for the increase in the value of Bitcoin from time to time.

Bitcoin vs USD (BTC/USD)

BTC/USD is a pair of trading instruments in financial markets. In this case Bitcoin vs USD, BTC represents Bitcoin while USD represents the US dollar.

All trading platforms, most of them offer this asset for trading. Because Bitcoin is included in the leading digital currency or major cryptocurrency.

With the growth in cryptocurrency trading, the existence of BTC/USD can be an alternative for traders to try to get profit from changes in the value of this pair.

On the exchange platform, you can find symbols of this pair. Such as some brokers that have offered crypto accounts, such as TenkoFX, FXOpen, and so on.

The advantage of using a crypto account at a forex broker is leverage, which means buying and selling using margin trading. As an asset that is a major currency, this pair’s daily trading volume is higher than other pairs.

The average daily volume of Bitcoin is measured in 127,426 units, which has been increasing regularly in 2020 since the sharp decline last March.

From the chart above we can see, in the midst of a global recession due to a pandemic that has yet to end. The Bitcoin index volume increased significantly in 2020 until the end of this year.

Working from home also plays a role in increasing trading volume on Bitcoin. This is something of particular interest to analyze how the future Bitcoin will value against the USD.

This phenomenon can repeat the old history when Bitcoin went up significantly and then suddenly fell as if a bubble burst.

BTC/USD Trading

Bitcoin vs USD trading can be done by approaching ways like doing technical analysis in forex. Apart from that, by studying the growing use of Bitcoin as a crypto digital currency.

The more users adopt Bitcoin as a payment alternative, the higher the value of Bitcoin.

BTC/USD trading technical analysis, for example, by adding a moving average indicator as a tool to identify trends.

This is the simplest way in market analysis to see the direction of the trend. In simple terms, if the Bitcoin price is above the moving average line it indicates a bullish trend. Conversely, if the Bitcoin price is below the moving average line it means that the trend is bearish.

The basic function of a moving average is to see the direction of the trend but to get a confirmation signal. Traders usually use two moving averages with the rule of crossing MA lines as a signal.

The picture above shows a simple trading strategy MA Cross. Even though the settings are simple, in practice you will encounter a lot of difficulties. Because after crossing, in just under an hour, the price may have reversed.

So you have to think about the right time for an exit point. Because this is the spearhead of a transaction in the financial market.

Bitcoin calculator to USD

Maybe if you have some Bitcoin stored in your wallet. Sometimes you are confused about how much Bitcoin value you have if it is converted into the local currency of your country. How to convert Bitcoin vs USD?

There may be no problem if you store Bitcoin in a local exchanger so that it can be easily converted to the local currency.

But if the stored Bitcoin does not have a calculator feature to convert to local currency. All you can do is use a Bitcoin calculator.

You can try to use the Bitcoin calculator by Coindesk, or Coinmarketcap. Simply step, you just need to type the amount BTC that will convert. Then choose currency on the list.

Final thought

Bitcoin VS USD is a fiat currency competition with digital currency. With all the advantages that Bitcoin has, it has been able to increase its value.

However, be aware that a significant increase will have a saturation point. So that many traders take profits when the price is too high which consequently the price drops again.

Ready to start trading?

Open an account or try Demo account.

Read another article

Scam list in Crypto, Beware before investing