Defi decentralized finance

Defi decentralized finance is a part of blockchain technology that promises open source to create various financial services and products. One reason for the emergence of the Decentralized Finance system. That there are still many people in the world who have difficulty gaining access to financial services.

Indeed the conventional financial system currently plays a role in building wealth. Especially for the world’s population but is unable to touch the lower classes of society. There is no single point of failure in decentralization finance. This is because all the same records are stored by a computer or node over a peer to peer network.

Because of the permissionless nature of the blockchain network, it is open to anyone, regardless of how many funds they have, where they live. In contrast to banks or payment companies that can close accounts from customers if they do not meet the requirements. The Defi decentralized finance system does not happen that way.

So what exactly is Defi decentralized finance? What are the benefits?

Stay safe at home and work from home, with TenkoFX

TenkoFX company regulation by IFSC Belize

Open an account or try Demo account.

What is Defi decentralized finance?

Defi meaning Decentralized finance is a financial application in an ecosystem built on a blockchain network. Defi definition short by Decentralized Finance that more specifically is a movement that aims to create open-source financial services.

Without requiring permission from any party, transparent and available to everyone. Who operates without a centralized authority. Users have full control over assets owned and can interact in the ecosystem through decentralized applications (Dapps), peer-to-peer (P2P).

The main function of Defi decentralized finance is the ease of accessing financial services. Mainly for those who are not touched by the current financial system.

Defi also makes it possible to create a modular framework that builds on interoperable Defi applications on a public blockchain. And create new financial services.

What are the benefits of Defi?

Some of the benefits of Defi include global access to all financial services, lower cost cross-border transactions, better privacy security, easy to use, and also censorship-resistant transactions.

So far, financial services depend on institutions such as banks that act as intermediaries, for which they offer certain fees that are more expensive. While financial services built on the Defi application do not require these intermediaries.

The codes in the application determine the resolution of any dispute that may occur, and at any time the user can access funds and have full control. So in terms of cost, this will reduce product services as in conventional systems through intermediaries. And even this is limited to intermediary working hours.

The risk of a single point of failure can also be minimized because financial services in this Defi system are installed on the blockchain. Censorship of transactions or potential service closures is almost impossible because all data is recorded on the blockchain and spread across thousands of nodes.

Installing the Defi application is also easier because the framework was previously created to facilitate the installation of the application. Using the Defi cryptosystem provides easy access to services for everyone who so far may not have access to financial services.

It is different from conventional services through intermediaries which are mostly only available in certain locations because they want to make a profit.

The development of the Defi system can reduce costs significantly, and not only high-income people but low-income people also benefit from broader financial services.

In specific term benefit or impact Defi payments is the following:

Global access to financial services

With decentralized finance, anyone who has an internet and smartphone connection can access various financial services that were previously constrained by conventional systems that are limited by:

- Status: there are citizenship restrictions, documentation.

- Wealth: Limits that are high enough to access financial services.

- Location: Long distances between economic activities and financial service providers.

In a Defi decentralized financial system, traders in world financial companies will have remote access anywhere.

Affordable Cross-Border Payments

Defi Decentralized finance eliminates expensive intermediaries and makes remittance cheaper for the whole world. In the current financial system, it is very expensive to make remittances between countries with an average remittance fee in the range of 7%.

Comparably higher than through decentralized finance services, remittance fees can be reduced to below 3%.

Better privacy and security

With Defi decentralized finance, users who have direct access to their accounts and allow them to make transactions securely without validation from the central authority.

While in centralized finance, the central institution stores all the wealth of its customers, and user information also faces the risk of abuse.

Transactions are immutable

In a decentralized system, transactions are immutable and the blockchain cannot be closed even by the government. To securely funds, users can transfer funds to decentralized finance to protect their funds.

For example, in Venezuela. There are so many people who move their money to Bitcoin to protect their wealth from currency manipulation and high inflation.

Easy to use transaction

With the Defi decentralized finance, making transactions is easier if comparing with the complexity of a centralized system for similar services. For example, with a decentralized system, Malaysian farmers can get investment from their business from users of different countries.

What is the use of Defi Decentralized finance?

1. Borrowing and Lending

The use of the Defi lending application is one of the popular uses of the Defi system. Borrowing and lending which are open in the Defi crypto lending rate system have many benefits when compared to traditional credit systems.

These benefits include instant transaction completion, guaranteeing digital assets without credit checks, and for the future have the potential for value standardization.

Lending applications in the Defi system can reduce the need for trust and have guarantees of cryptographic verification methods. Because this loan service is built on a public blockchain.

The lending market on the blockchain minimizes impacts the risk that may arise from other parties so that lending becomes faster, cheaper, and available to more people. Crypto lending rates usually high for stablecoin interest rates between 7% -15% and lower levels of crypto assets such as ETH and BTC between 0% -1%.

Open lending

Open lending has several advantages over traditional credit applications, for example:

- Integration between the lending and borrowing processes.

- Digital/cryptocurrency assets can be guaranteed.

- Instant settlement and safe lending method.

- Have greater access for many people who cannot get traditional financial services, because there is no credit rating check.

- Interoperability and standardization reduce costs with automation.

By using a crypto lending like MakerDAO, a person can get liquidity (cash) from the crypto without having to withdraw the ETH. But make it collateral and because the ETH remains there and is not disbursed, he does not need to deal with capital gains tax.

Crypto lending risk

Crypto lending is usually intended for crypto holders who need cash but still want to hold the cryptocurrency and do not want to liquidate from the crypto.

In the event of liquidation, the borrower is also subject to liquidation fees, for Makerdao at 13%, Dydxprotocol 5%, and Compoundfinance at 5%.

The cash obtained certainly does not amount to 100% of the crypto assets pledged, on average by 50% less than the collateral. This means that if the collateral value of ETH or Bitcoin has decreased sharply to 90%.

You must add to your collateral if you do not want to liquidate to cover your loan automatically.

Secured lending or loans that use cryptocurrency as collateral like MakerDAO are designed to depend on “trust minimization” or do not need the trust provided by blockchain technology. To reduce the risk of default from borrowers without the need for intermediaries.

This is done through basic cryptography with a verification method that is done through a public blockchain.

2. Banking monetary services

Like as the Defi definition is decentralized finance, so the use is for banking monetary services. These services can be in the form of Stablecoins, mortgages, and insurance.

If the blockchain industry is advancing day by day there will be an increase in the issuance of Stablecoins. Stablecoins are crypto assets that are pegged with flat money assets and can be transferred digitally with relative ease. For example USDT.

The use of Stablecoins in the Defi system can be adopted for daily use as digital money that is not issued and monitored by a centralized authority. Because if you use altcoin cryptocurrency the value can fluctuate.

To get a mortgage on a conventional system usually requires an intermediary and can take a long time. In the Defi system using smart contracts, the registration fees and legal costs can be reduced significantly and faster.

Insurance on the blockchain can reduce the needs of third parties and allow risk-sharing among many participants. The result is lower premium costs but with the same quality.

3. Decentralized market

In this market still need financial innovation. Defi Decentralized Finance is one of the challenging systems to be applied in this market. For this, the most important Defi application development is decentralized exchanges (DEXes).

With the availability of this platform, users can trade or transact digital assets without the need for intermediaries or exchanges.

If these Decentralized Exchanges are available, trading can be directly between the user’s wallet with the help of smart contracts. This requires lower cost maintenance, the decentralized exchange allows lower trading costs than a centralized exchange.

Blockchain technology can be used to issue broader ownership of conventional financial instruments. These decentralized applications will remove the role of intermediaries and eliminate single points of failure.

For example, security token issuers’ platforms. They can provide tools and resources for publishers to launch securities denoted on a blockchain with adjustable parameters. Other top Defi projects can be developed for making derivatives, synthetic Defi pulses, decentralized prediction markets, and many others.

The role of smart contracts in the Defi system

Smart contracts in decentralized application applications are always a part of the app’s framework. Smart contracts use computer code. This is different from ordinary contracts that use legal terms to involve everything that will be in the contract.

Smart contracts have the unique ability to enter these agreements via computer code. With this, execution and automation are more reliable in the processing of large amounts of transactions that currently require manual supervision.

The value of smart contracts is that transactions are faster, easier, and reduce the risk of mistakes by both parties.

But there is indeed a possibility of risk if the computer code is meet bugs so the confidentiality value of information locked in smart contracts risks vulnerability by hackers.

Difference between Defi and traditional Banking

In traditional banking where third-party financial service providers are given security access to financial data through APIs. So that there are links between accounts and data between banks and non-bank financial institutions.

While Defi is a financial system that does not depend on existing infrastructure. For example, traditional banking can enable the management of all traditional financial instruments in one application by pulling data from several banks and institutions safely.

On the other hand, Defi can offer the management of new financial instruments and new ways to handle them.

Defi Challenge

Blockchain is slower than other similar applications that are centralized. Defi application developers must optimize their products faster.

Defi applications carry out direct trading without intermediaries, allowing for negative effects between users and public society. In order for the Defi application to become a major element in the global financial system, this application must provide tangible benefits that encourage users to move away from traditional systems.

The next challenge is not only building applications but also thinking about how these applications fit into the wider Defi ecosystem.

Decentralized Finance Architecture

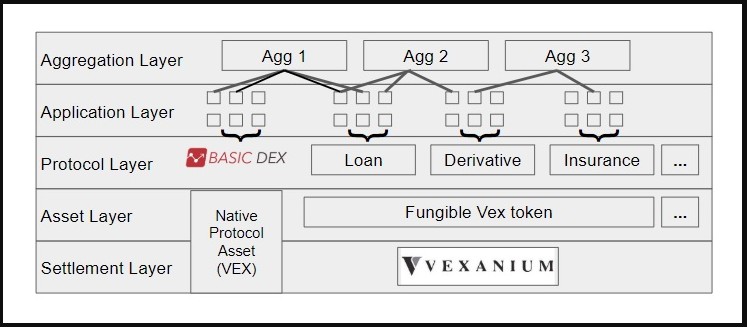

Defi has a multi-layer architecture where each layer has its own function. One known architecture is the settlement layer, assets, protocol, application, and aggregator layer.

- The settlement layer consists of the blockchain and native assets of the protocol that allows storing ownership information and ensuring the existing state matches the rules of the blockchain network. Blockchain here serves as the foundation of trustless execution, can serve settlement and dispute resolution.

- The asset layer consists of tokens that are issued above the settlement layer. Including the native assets of the protocol and other tokens created based on the blockchain.

- The protocol layer provides specific standards for use cases such as decentralized exchange, derivatives, on-chain management, etc. This standard is a set of smart contracts that can be accessed by users or Defi applications. So this protocol is usually interoperable.

- The application layer is the application used by users and is connected to individual protocols.

- The aggregator layer is an extension of the application layer. Aggregator creates a user-centric platform that is connected to more than one application and protocol.

Usually providing tools for comparing prices and services to make it easy for users to use, the aggregator layer also connects several protocols together and combines relevant information.

The depiction of the Defi architecture is as follows:

Decentralized Finance Conditions for 2020

Decentralized Finance Defi in the world of 2020 is quite a lot of news, whether it’s good or bad news.

Flashloan hack

Flashloan is a new type of Defi and allows crypto traders/investors to get rich by taking loans without capital, and arbitrate in exchange with these funds, then return it directly in 1 transaction.

But there is indeed a debate here, whether this is a hack or a valid arbitrage technique.

Liquidation Trouble at MakerDAO

MakerDAO based on Ethereum, facing problems when the ETH price fell on March 12. Where if the price fell, the smart contract would liquidate the ETH or BAT guarantee, cut liquidation costs, and return the remaining funds to the borrower.

But at that time many borrowers did not get anything because the ETH network was “stuck” so that many liquidators could not participate. There was only one liquidator who could enter and buy collateral at a price of $ 0. But this situation seems to be faced by the Maker Foundation by conducting auctions.

Like most new technologies or new places to invest, of course, Defi does have risks. There is no return without risk. Of course in the future, this risk will be further minimized by the increasingly good technology of blockchain and decentralized finance.

Final thought

Defi decentralized finance is a financial service system that is different from traditional financial services that are currently used by many people. If this system succeeds in shifting the conventional financial system then this allows more financial systems and has the potential to prevent censorship and discrimination precedents throughout the world.

This concept is certainly very challenging and interesting, but not all will be satisfied with decentralized finance. The developer should find suitable uses for the blockchain characteristics.

This is important for the development of useful open source products.

Will Defi succeed in taking power from the large centralized organizations and putting it in the hands of open-source people and communities? time will give an answer.

Are you ready to start crypto trading?

Open an account or try Demo account.

You may read

Best mobile crypto trading app 2020

When was bitcoin cash created?