Central Bank Digital Currencies (CBDC)

Maybe you have heard of Central Bank Digital Currency, as the term suggests, this is a central bank that specifically regulates and distributes cryptocurrency.

Even though it is still in the research and planning stage in several countries, this might shift the position of cryptocurrencies such as Bitcoin. One of the countries that have tested its digital currency is China with Digital Yuan.

What exactly is the Central Bank Digital Currency like? In this paper, we will be talking about CBDC from various points of view.

Best TenkoFX broker. Good forex Brokers with positive feedback of reviews from users and are regulated by IFSC Belize

Open an account or try a Demo account.

What are Central Bank Digital Currencies?

Maybe you think that the CBDC is a central bank that issues cryptocurrency, but in fact, the central bank digital currency (CBDC) is an official government institution that has the right to issue fiat currencies issued in digital form from the central bank.

Central Bank Digital Currency (CBDC) is different from cryptocurrencies such as Bitcoin, Ethereum, and others.

If you have learned about a cryptocurrency like Bitcoin it is designed for a payment system that can function independently of the authority of financial institutions and governments.

In other words, Bitcoin and several other cryptocurrencies are decentralized, no authority has full control.

Meanwhile, CBDC is regulated by the central bank, which is part of a government agency that specifically regulates fiat currencies in digital form.

In simple terms, CBDC is centralized, very different in concept from cryptocurrencies such as Bitcoin and the like which emphasizes decentralization.

Central Bank Digital Currency how it works

At this time online transactions have experienced a very significant increase, especially during the pandemic which has indirectly forced many people to work from home.

Therefore, several countries have started in the testing and planning stages, although not yet reaching 100% will be able to operate, it provides a positive side for cross-border financial transactions.

Central Bank Digital Currency works must not only be issuing digital currency and distributing it but also must be able to provide multiple security guarantees because vulnerabilities in online transactions are hackers.

In addition, it must also have interconnections with other payment methods to facilitate transactions.

Central Bank Digital Currencies BIS

The Bank for International Settlements (BIS) in a survey conducted in January 2020 showed that around 80% of the total 66 central banks that participated in the survey were working on digital currencies.

Furthermore, about 40% of the 80% who do the work have started to enter the proof-of-concept stage.

With rumors about digital currency by CBDS, this is actually the influence of the emergence of the blockchain technology adopted by Bitcoin. CBDC is expected to provide convenience to users and also low costs in online transactions as in Bitcoin.

Central Bank Digital Currencies and Cryptocurrencies

Even though they are both digital currencies, CBDC has a different concept from cryptocurrencies in general.

CBDC issues a digital currency that is supported by the trust of its people and backed up by the government. So the right to issue electronic currency is a central bank, not a commercial bank.

Meanwhile, commercial banks can function as distributors of digital currency.

Although it is still a concept and research, it is possible to adopt blockchain technology which has the advantages of transfer costs and transfer speeds that are better than traditional systems.

Difference with cryptocurrency

Cryptocurrency like Bitcoin is a pure decentralized digital currency, for which no special authority has control over currency distribution.

Meanwhile, confirming a transaction requires miners who must be able to solve complex algorithms and will be rewarded with BTC.

To confirm a transaction, the higher the fee spent, the sooner the miner will confirm the transaction.

Central Bank Digital Currencies china

It seems that China’s efforts in developing a digital currency have started in 2014 when the People’s Bank of China formed a team to research cryptocurrencies.

Although China is one of the countries that prohibit Bitcoin, the fact is that they are developing the yuan digital currency as inspiration for cryptocurrency.

In China alone, the most widely used payment wallets are Alipay and Wechat pay, which have led to more than 500 cryptocurrency projects.

Central Bank Digital Currencies Bank of England

The Central Bank Digital Currencies Bank of England has also started in the development phase.

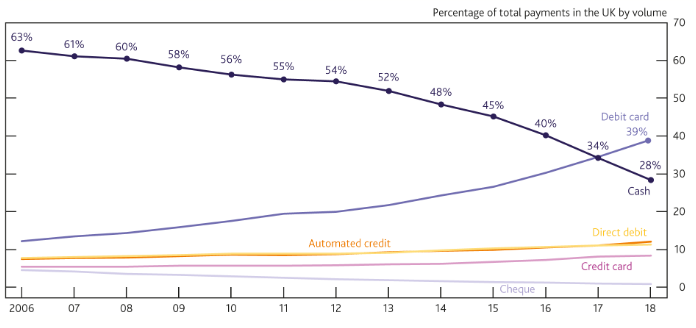

It seems that the Central Bank of England is very enthusiastic about the development of digital currencies through CBDC because the use of cash has significantly decreased, while electronic transactions have increased from time to time.

Central Bank Digital Currencies Asia

Asia is the largest continent, and an economic giant is growing here, China has launched the Digital Yuan.

In addition to that Asian country that has made efforts to develop digital currencies such as Korea, Japan, Cambodia, Indonesia, and will overtake other countries because of the impact of the digital economy needs to make a transition to this method. easier and safer payments.

List of Central Bank Digital Currencies

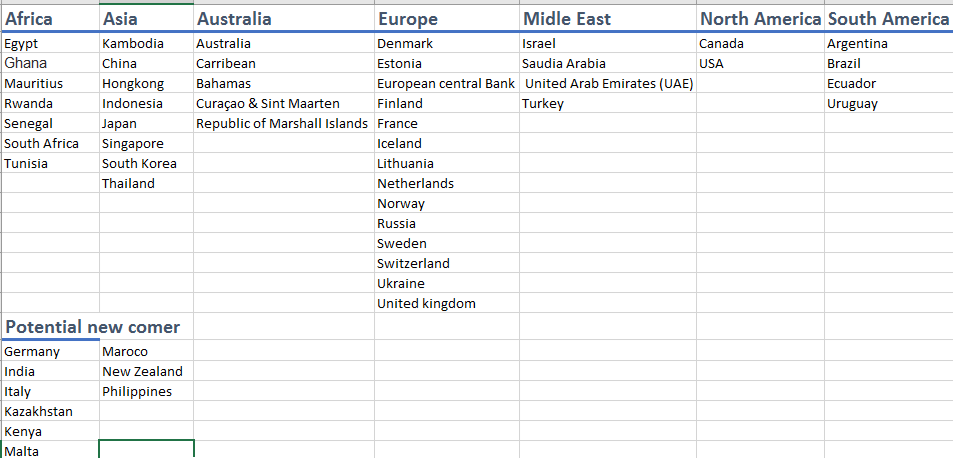

There are hundreds of countries around the world. But referring to survey conduct by BIS, there are 66 central banks as respondents with 40 of them having the desire to develop a Central Bank Digital Currency.

List of countries that develop digital currencies globally from the African continent, the Asian continent, the Australian continent, the American continent, countries in the Middle East region.

The list is taken from blog.stomarket which was updated on June 15, 2020.

Central Bank Digital Currencies foundational principles and core features

In developing CBDC according to information in Central Bank Digital Currencies foundational principles and core features. BIS.ORG. CBDC must have three basic principles in the development of digital currency by central banks.

Don’t harm

CBDCs must be able to fulfill the objectives for public policy and must not interfere with the central bank to carry out its mandate in achieving monetary and financial stability.

Coexistence

In developing CBDC the central bank must be careful. The money issues by the CBDC must complement and coexist with other commercial money to support public policy goals. Meanwhile, the central bank must continue to provide cash according to public demand.

Innovation and efficiency

The central bank that will build the CBDC must have innovation and efficiency to meet the needs of the economy and consumers.

Anything that has the potential to break monetary and financial stability should be avoided. In order to continue the payment ecosystem by central banks and private agents.

In this case, the public and the private sector must create a system that is safe, efficient, and accessible. The private sector should be free to decide which payment instrument they use to make transactions.

Core features

The core features of CBDC are split into three cores, instrument feature, system feature, and institutional features.

Instrument feature

In this feature, CBDC should have a requirement:

Convertible

This feature is to facilitate the exchange of digital currency with fiat money in general.

Convenient

This feature should be available for ease of payment as well as cash. Either by card or scan mobile easiness of payment access.

Accepted and available

This feature must exist to be used in many types of transactions including point of sale and person-to-person.

This will include the technology’s ability to take it offline transactions (possibly for a limited period and up to a predetermined threshold).

Low cos

This feature should available for the purpose of public convenience, the high cost of causing user losses.

System feature

The system feature must support user security, it must be free from cyber attacks that can harm the user.

The feature system should also provide instant payment to person to person easily.

The system must also be resilient and not fail to operate, which may cause user losses.

It should also be available 24 hours 7 days a week so that users can use it at any time.

Another feature must be able to process a very high number of transactions. Scalable fit to accommodate large future volumes.

Interoperable so that it can offer adequate interaction with the digital private-sector payment systems and arrangements to facilitate the flow of funds between systems.

Institutional features

The institutional feature must have a strong legal framework, this is to support the issuance of CBDC. And also there must have a Standard system on the CBDC infrastructure and all participating entities.

For full report foundations and principals and core features, you can find them in BIS.org.

How Central Bank Digital Currencies will take over the world

Central bank digital currency is currently a topic that many people are busy talking about.

The concept of digital currency from CBDC is a country’s fiat currency in the form of digital currency. China has already conducted a digital Yuan trial. And central banks in several regions have started to realize this project.

If all countries already have CBDCs, it is not impossible to take over the world financial system into more sophisticated financial technology.

However, whether this CBDC will be able to provide satisfaction to users is still too early to discuss. Bitcoin, after all, was the first digital currency to use blockchain and ledgers.

And the idea of CBDC emerging due to market pressures. After the emergence of Facebook’s Libra. This was clearly a central bank restriction because it would endanger the global financial system in his opinion.

Apart from that Ethereum and other cryptocurrencies are making the crypto market grow very radically.

Will central bank digital currency replace bitcoin?

Bitcoin from the beginning has big challenges from official authorities. The reason is considered to have no character as a currency. The value fluctuates drastically which poses a risk to the user.

But even though many are mocking Bitcoin, the fact is that the cryptocurrency market has seen a huge increase.

Bitcoin is indeed a controversy, but even though many countries prohibit using Bitcoin, there have been efforts to regulate cryptocurrency.

Whether CBDC will take over Bitcoin? Technically because CBDC is by the government, it is possible that the existence of Bitcoin will face a big challenge from the official authorities.

Should central banks issue digital currencies?

This question is also many who want to get an answer. The reason why central banks should issue digital currencies includes the following market demand.

Since the Covid19 pandemic, the use of cash has decreased and many users have chosen through electronic transactions.

With the issuance of digital currency, there are a wish that it will provide convenience for transactions even though it is cross-border.

Central Bank Digital Currency benefits and drawbacks

There will be several advantages considering that this developing currency is with Blockchain technology which has many benefits, especially in terms of speed and cost reduction.

In order to improve the efficiency of inter-platform payments, CBDC can reduce the risk of securities transfer in the interbank network. Some of these benefits include:

- Increase efficiency in financial technology.

- Reduce costs in banking activities.

- Reducing the risk of tax default.

- Prevent crime like money laundering.

- Optimizing security in the payment system.

Drawbacks CBDC

One of the risks of using CBDCs is the potential for bank runs. It means massive withdrawals of funds by customers from financial institutions almost simultaneously.

However, the Central Bank of England found that if the introduction of CBDC has followed a number of basic rules. Hence the risk of the bank run can be mitigated.

Apart from these risks, another risk is cybercrime. Not only is cryptocurrency a target of crime, but CBDCs may also be targeted by criminals in sophisticated ways. Therefore CBDC must have high-level security support from cybercrime.

Another risk is an implementation in society, this requires education regarding the use of digital currency.

Final thought

With CBDC, the world’s hope is to get the ease and speed of financial transactions at low costs. Making international transactions is as easy as the touch of a finger. Don’t need to go to a bank to make money transfers.

And the existing features should be superior to Bitcoin or other cryptocurrencies. Because the success of Bitcoin is inseparable from the concept of ease and speed of global transfers at low fees.

Ready to start trading? Open an account or try a Demo account.

Read more article