Is bitcoin a safe haven?

Is bitcoin a safe haven? This question will be very interesting for investors, especially those who hunt for cryptocurrency assets.

After last March the value of bitcoin dropped very dramatically, slowly its value began to rise again.

Amid the current pandemic conditions, global economic conditions are threatened with the possibility of a recession, as JP Morgan said.

Bitcoin is one of the digital assets that can be traded by retail traders and institutional traders.

Some opinions state that bitcoin is gold in digital form, so it can be a safe haven.

Currently, the price of Bitcoin is at the level of $7702 on the Tradingview chart, which in March had reached the lowest level of $3900.

If you see this condition actually also occurs in stocks, and oil, oil prices have dropped dramatically since the pandemic coronavirus beat the global economy.

Then discuss is bitcoin as a safe haven? It is still very interesting to get an analysis of the future.

Get profit from Bitcoin trading with TenkoFX

TenkoFX has positive feedback of reviews from traders and are regulate by IFSC Belize

Open an account or try Demo account.

Bitcoin is not safe haven, but probably something more

Citing from Cointelegraph, Bitcoin has its own value amid the coronavirus storm that swept the world. This can be an asset like gold, even though its value is still a lot of pressure in the world.

Why is that? If we think about the devastating economic conditions in many countries.

This will encourage many countries to ask for loans, and paper money may be printed in larger amounts and encourage inflation.

While Bitcoin will not be printed with a new one so it will be resistant to inflation.

But after all paper money is still very necessary in daily life where people can buy things easily. Because not everyone knows bitcoin, especially in remote countries.

Look from the current market conditions that are still quite bad due to the corona outbreak that is still sweeping the world, Bitcoin in the future is still quite speculative.

Some experts say that investing with crypto might look as careless as gambling with rent.

Crypto market volatility is higher than flat money, the possibility of making the Hedge Fund will reduce exposure to crypto-assets.

In the midst of a wave of the global economy caused by the Coronavirus, the outbreak will alienate investors from volatile equities.

The impact of a pandemic is very real and uncertain when it will ends.

Investors or businesses will likely be looking traditional safe-haven assets, such as gold and government bonds, some doubt cryptocurrency assets including Bitcoin.

Bitcoin VS Dollar

News recently came that the US gave a massive injection of stimulus as a step in dealing with a pandemic coronavirus.

This step is an interesting topic for many people in the crypto industry.

The massive stimulus is accused of making the government print money without stopping.

And this topic became so significant, sparking further Bitcoin vs US Dollar debates.

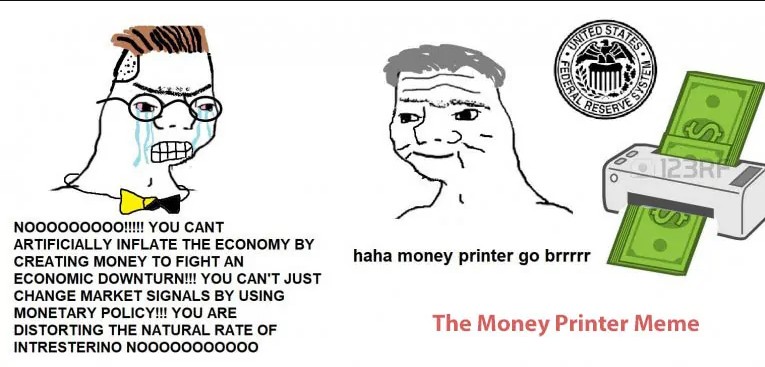

This debate made some people in the crypto environment make funny memes.

Crypto observers claim that large monetary injections will encourage the printing of money which inflates the supply of the US Dollar.

In this condition Bitcoin vs US Dollar: BTC is said to be more standing tall.

With reference to this analysis, some analysts state that printing large amounts of money is bullish for Bitcoin and bearish for the US Dollar is invalid.

Loose monetary policy may not interfere in the short term for economists, forex traders, and investors.

But in the long run, the importance of decentralized cryptocurrency such as Bitcoin has greater opportunities.

Although the direct implications of large spending by the Federal Reserve may not be seen by those who interact and hold U.S. Dollars.

Economist observers emphasize the need to have a decentralized currency like Bitcoin. Although this can damage Bitcoin in the short term.

Bitcoin VS Gold

Bitcoin and Gold have become one of the attractive investment assets for investors.

However, the increase in the value of the two assets that occurred simultaneously brought back the debate over which investment assets would be a better place to store value.

Gold or Bitcoin, which one is more profitable?

In hindsight, since bitcoin has experienced a sharp rally in 2017. So many investors have stated that bitcoin has a gold-like nature.

So Bitcoin as the largest market capitalization called Gold in digital versions.

As a result, until now the market often compares gold with bitcoin and analyzes which assets can benefit greater investors.

Looking at the supply side, both assets have a limited amount of supply.

Limited supply

The amount of gold available on Earth is limited, the World Gold Council estimates that the supply of above-ground gold increases by around 1 percent to 2 percent per year

Meanwhile, bitcoin will only have 21 million coins spread in the world.

Therefore, bitcoin is expected to be last mined in 2140, according to a controlled inflation schedule and value.

In addition, bitcoin price volatility has limited its use as a store of value.

Since its launch, the change in the price of bitcoin has been 5 times more volatile than gold, making it difficult for traders to accept the cryptocurrency as payment.

Meanwhile, the average change in intraday bitcoin prices in the last 2 years exceeds 6 percent, even though volatility has declined.

Proponents of gold often say that an asset cannot be a safe store of value when it has seen a decline of more than 80 percent in just 12 months.

But in fact, real gold is also not entirely stable.

September 2011 to December 2015, gold decreased by 45 percent against the US dollar.

Morgan Barna as a Bloomberg Intelligence analyst said that instead of positioning gold and bitcoin as opposing assets. The two assets can be used as assets that complement each investment portfolio.

Bitcoin VS stock

Stocks as securities traded on the capital market where people who become shareholders will get the dividends and capital gains (the profits we get when selling shares are higher than the purchase price).

Buying and selling Bitcoin is the same as stocks because get gain from the difference between the selling price and buying price Bitcoin.

One of the price movements in shares is influenced by company performance such as an increase/decrease in profits and sales, dividends, or news that is publicly released about the company’s condition.

Bitcoin, its unit price is also strongly influenced by the same thing: the increase and decrease in demand, and the press that circulates in the community.

For example bad news about fatal mistakes in Mt. Gox has caused a drop in the price of Bitcoin.

Despite having the same causal factors, the price movements of Bitcoin and shares are quite different.

Bitcoin has fluctuating and unstable values.

As for stocks, the value is slow, but it is quite stable and not as vulnerable as Bitcoin.

Look by the comparison, both Bitcoin and shares are both profitable in different ways.

If you prefer high-risk investments with high profits, then Bitcoin could be the right investment choice.

Conversely, if you don’t want to take too much risk, investing in stocks is safer.

One advantage of Bitcoin over stock is that in terms of minimal investment. Bitcoin can start with low capital. While stocks require greater capital, there are even several ways to get Bitcoin for free.

Expert opinion

Managing Director of Wedbush Securities Inc., Gil Luria. He revealed that digital currency is a safe hedge, especially versus conventional currencies. Such as pounds which may be vulnerable due to Brexit.

The reason is that the market sees Bitcoin as an asset that will not relate to the monetary conditions of the country and the world like precious metals.

Even though Bitcoin is very volatile, it is better than conventional British currencies which can drop 10 to 30 percent in just a few weeks.

While Michael Vogel from Netcoins also revealed to some people, Bitcoin is still a very risky investment.

But there are other people who rate Bitcoin as the highest safe-haven investment.

While the CEO of the payment company Crypto Circle, Jeremy Allaire. He revealed that the turbulent macroeconomic conditions such as the trade war have an influence on the growth of Bitcoin to date.

Is bitcoin a safe haven?

Forbes analyst Chris Reinersten revealed that there was a huge “flight of funds” towards all safe-haven assets, including Bitcoin.

In his observations over the past few years, according to him Bitcoin increasingly has a relationship with global fundamental conditions.

Even more so when there are many macro steps and increasing uncertainty in the global economy.

Reinersten’s expression is in accordance with several facts on the ground.

Like when trade disputes escalated because the US accused China of currency manipulation, the price of Bitcoin was seen rising.

Reinersten also said that the Chinese government’s decision to let the Yuan exchange rate fall to the lowest area in a decade against the USD. It was a factor causing markets to move their funds to the digital currency Bitcoin.

Contradiction

However, there are other views about bitcoin a safe haven.

As the head of the investment strategy, a banking company Brian Belski of BMO Capital Markets gave a statement that opposed the safe haven of Bitcoin.

He said that it was still too early to classify Bitcoin as a safe haven asset because the global economy was full of uncertainty.

Those who disagree with Bitcoin as a safe haven indeed view that crypto prices are too volatile and sensitive to be a hedged asset.

One proof comes from a Bloomberg report, which revealed that there were around 318 Tether-owned Wallet addresses with a value of around $ 1 million.

This amount represents around 80 percent of the total global BTC supply.

Final thought

Is Bitcoin a safe haven? This is still a debate that has not ended. However, the chances are still high to make Bitcoin a safe haven.

If monitoring the latest price changes where the tendency of the value rose significantly, allowing the demand for Bitcoin will increase post-halving which will occur in May.

However investors can wisely choose Bitcoin as one of the safe-haven alternatives, but it’s good that this is not alone. Other assets such as gold are still considered safe haven that needs to get a portion of the investment.

Are you ready trading bitcoin?

Open an account or try Demo account.

May you read another article

Crypto Securities Exchange (CSX)

Bitcoin SV, Some important things from Bitcoin SV

Cryptography and network security

Introduction to blockchain technology