Bitcoin halving date 2020

Bitcoin halving is an interesting event for crypto fans, especially Bitcoin, did you know about Bitcoin halving date 2020?

Bitcoin halving date 2020 has passed on May 11 a few days ago. This is a 4-year cycle of the Bitcoin halving event and to date in every 210000 blocks. Bitcoin has occurring halving, 2012, 2016, 2020, and going forward in 2024, until it is estimated that in 2040 where it will be the last halving, and the reward for miners will be zero.

What is the reason for this halving?. All cryptocurrency enthusiasts know that Bitcoin is a digital currency that is different from a flat currency.

It is created in a certain amount. Unlike flat money that will often print new banknotes if needed.

Weaknesses in the fiat money system are vulnerable to inflation. Because printing new money means increasing the supply of money and if the number of transactions remains, it can cause inflation.

Bitcoin itself was created only by 21 million Bitcoin and there will be no additions. And that number is expected to be depleted in 2040.

Because the amount is fixed then the possibility of inflation is very small but allows its value to increase.

Stay safe at home and work from home, with TenkoFX

TenkoFX company regulation by IFSC Belize

Open an account or try Demo account.

Bitcoin halving explained

Bitcoin halving is a way to control the circulation of Bitcoin by lowering the miner’s reward by half. Because there is only 21 million Bitcoin in the whole world, it needs a way for circulation to go according to plan.

The Bitcoin mining model is to adopt as gold mining. Gold is estimated to have a limited amount worldwide.

Gold mining is increasingly decreasing it will dig deeper into the earth deeper. And like that Bitcoin adopted Bitcoin halving by lowering the miner’s reward by half from before halving.

Halving will be done every 210000 bitcoins, and since launch in 2009. Bitcoin halving dates history start in 2012, where miner’s reward decreased to 25 BTC. Then the second bitcoin halving was in 2016 where miner’s reward was reduced to 12.5 BTC. And bitcoin halving recently took its third time on May 11, 2020, where the Bitcoin reward was reduced to 6.25 BTC.

Bitcoin halving will continue to be done every 210000 blocks until finally, the miner’s reward becomes zero.

Reason for Bitcoin Halving

The number of Bitcoins circulating in the public will continue to grow to the maximum limit of 21 million BTC. Bitcoin halving has the aim of ensuring control of bitcoin supply. The rules in Bitcoin are designed to gradually decrease miner’s reward every four years.

This reward will be split by half on each bitcoin halving until the 21 million Bitcoin circulating on the market is reached. Thus, this system can ensure the value of Bitcoin continues to rise.

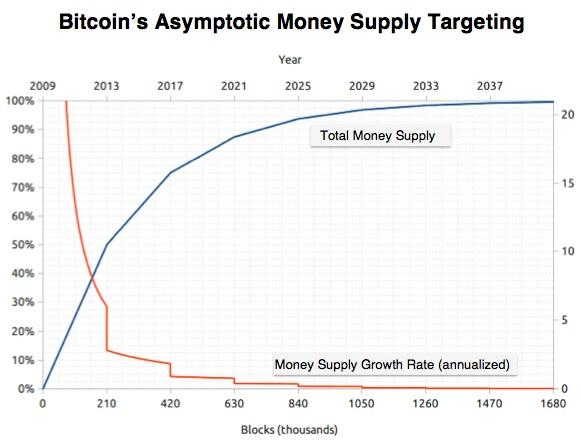

The theory in the graph below states that changes in the Supply level cause proportional changes in the value of Bitcoin. Then the reduction in the level of coins in circulation for Bitcoin must lead to a proportional reduction. If we assume in terms of simple demand and supply law, it clear that the price of Bitcoin will continue to rise after Bitcoin Halving occurs.

Idea behind Halving

One reason for Halving’s idea, which is carried out periodically for four years. That there is no reduction in the value of Bitcoin from time to time.

In a statement, Satoshi Nakamoto said if new coins were produced it meant that the money supply increased according to the planned amount. So that if the money supply increased while the number of users also increased at the same rate, prices would remain stable.

But conversely, if the supply of Bitcoin does not increase as fast as demand. Then the value of Bitcoin will continue to increase. So that’s the halving will reduce the reward by half to reduce the rate of supply of Bitcoin.

Satoshi assumed to encourage sustainable growth, by choosing a logarithmic scale in setting Halving dates. This means that the last Bitcoin will not be released until 2140, even though 80 percent of Bitcoin supply has been mined in the first 10 years

Therefore Bitcoin miners still have more than a century of opportunity to get guaranteed rewards for their participation in the network.

Bitcoin halving dates history

Bitcoin halving date 2012 as the first halving celebration

The First Bitcoin halving date was on 28 November 2012. If previously the miner’s reward was 50 BTC but after halving the reward was reduced to 25 BTC.

So from then on there will be 25 BTC mined every 10 minutes if previously there were 50 BTC every 10 minutes. Thus this will reduce the growth rate of Bitcoin in circulation, and aims to reduce inflation in the value of Bitcoin.

How does Bitcoin halving 2012 affect the market?

The impact on the market at the first halving event in the history of Bitcoin does not directly make the value of Bitcoin rise. This is because the Bitcoin market at that time had a completely different environment. Bitcoin is not yet popular, event halving has an overall impact that is ignored by the market and mining community.

However, the reward was cut from 50 BTC to 25 BTC which is a huge difference. The price of Bitcoin did not really rise until mid-2013 after the first halving event. Before halving the value of Bitcoin is $ 12.

After the first halving, the price increase did not happen immediately and it took several months. This shows that the 2012 halving event was not the main cause of the slight increase in prices in 2013.

Bitcoin halving date 2016

The second bitcoin halving on July 9, 2016, at the time before halving the miner’s reward was 25 BTC and after halving was reduced to half to 12.5 BTC.

While the price before halving is $ 650 for one BTC, only after the first halving in 2012 to 2016 prices have gone up many times from $ 12 to $ 650. At that time Bitcoin was gaining popularity, and many people were talking about Bitcoin.

Impact on the market

Bitcoin halving 2016 is the second Bitcoin halving event. How it affects after halving is quite surprising, there is no substantial increase in the price of Bitcoin.

Hash rate will drop by 5 to 10 percent. There is almost no real change. In fact, the drop hash rate even becomes less than 1%. However, it is interesting to note that there is some price volatility seen before halving. The Bitcoin exchange rate has decreased by more than $ 30 so the price has dropped to $ 630 from $ 660. After halving, prices have stabilized at $ 650.

Bitcoin halving date 2020

Bitcoin halving 2020 is the third halving event if previously the miner’s reward was 12.5 BTC but after halving the miner’s reward was reduced by half to 6.25 BTC. This will reduce the supply of Bitcoin to the market because if previously 12.5 BTC were mined every 10 minutes now only 6.25 BTC was mined every 10 minutes.

The bitcoin halving 2020 event is on 12 May 2020. The price before halving is $ 8,525.

Impact on the market

Long before Halving Bitcoin date 2020 in May, many analysts believe after bitcoin halving 2020 price prediction that the value of optimistic Bitcoin could reach $ 10,000. But what happens in the market after Halving is not so big directly impacts the value of Bitcoin.

What happened was before halving the price of Bitcoin was in the range of US $ 8,525. But after Halving a few days after that, the price started to climb to the level of US $ 8,783.

Of course, it is quite far from the level of US $ 10.000 in the previous few days aka shrinking 14.75 percent.

When referring to the first and second halving to analyze. Indeed the price increase does not directly occur after halving. But requires time with the tendency of the value of Bitcoin to continue to climb.

Even now the price is still seen rising and reaching $ 9732. And if the demand for Bitcoin increases, while a decrease in the miner’s reward to only 6.25 BTC means that supply will decrease. And this can increase the value of BTC for some time to come.

A secret message before the Bitcoin halving date 2020

Bitcoin halving date 2020 occurs when the world is hit by a global crisis, where the pandemic coronavirus has caused a paralysis of the world economy. Many countries experience economic shocks due to lockdown policies that require their people to obey the government’s recommendations.

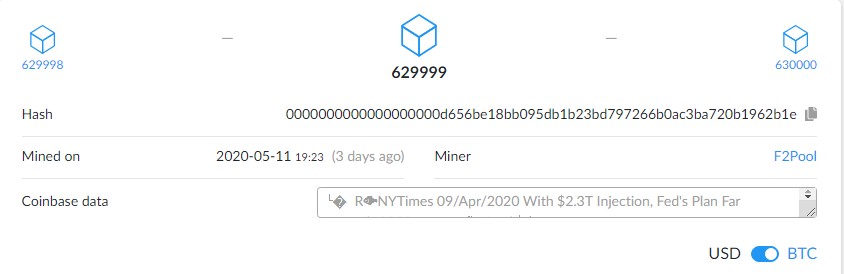

There is one interesting thing before Bitcoin halving 2020 which is that we know that bitcoin halving occurs every 210000 blocks, and in halving 2020 it falls at 630000 blocks. Actually the countdown time for Bitcoin halving is based on multiples of 21000 blocks, which on average takes 4 years.

Before bitcoin halving 2020, it turned out that there was a secret message embedded in the 629,999 blocks or one block ahead of the Halving block (630,000).

The message pinned in the 629,999 blocks was: “NYTimes 09 / Apr / 2020 With $ 2.3T Injection, Fed’s Plan Far Exceeds 2008 Rescue”. The message embedded in Bitcoin Halving 2020 refers to the news in The New York Times on April 9, 2020. About the plan to roll out additional funds by the Fed (Central Bank of the United States) to save the economy, the amount of which exceeded the 2008 crisis.

This message led Brian Kelly, author of The Bitcoin Big Bang, to CNCB, that when the US Central Bank undertook “quantitative easing” then Bitcoin did the opposite of “quantitative tightening”.

This message led Brian Kelly, author of The Bitcoin Big Bang, to CNCB, that when the US Central Bank undertook “quantitative easing” then Bitcoin did the opposite of “quantitative tightening”.

The negative side of halving bitcoin

The negative side of Bitcoin Halving is that many miners will stop their operations. Because the rewards they receive are diminishing. Especially individual miners. They can stop the machine because they think the reward they get is not commensurate with the electricity costs that spend.

Smaller rewards will make more miners lose money and move to other cryptocurrencies. With the reduction in the number of miners, this can affect the level of hashes on the Bitcoin network, which then affects the speed of user transactions.

Marco Streng, the co-founder of Genesis Mining, gave a price of $ 200 to produce one BTC on the first Halving. And the price was raised to around $ 400 after the second halving.

While large miners will continue to maintain operations despite lower revenues, the reason is that the costs incurred have not yet made a profit. Meanwhile, the number of inefficient small miners will decrease, because they do not get profit after the next Halving occurs.

The big miners even though they get a small revenue they hang their hopes on the rising price of Bitcoin in the future. Hope they can repeat the highest price of Bitcoin at the end of 2017.

Bitcoin halving 2024 date

Bitcoin halving date events are every four years. In every 210000 blocks so the next halving will occur around 09 May 2024. And there is still more time for three more years to see the growth of Bitcoin and its value.

Will the value of Bitcoin be safe to be a safe haven, or will price fall back. An analyst said that if the COVID vaccine had been discovered. And the Bitcoin price could touch $ 10,000 then the value would continue to rise, but if the price did not penetrate $ 10,000 and the virus vaccine had not been found then the value of Bitcoin would slide down again.

Final Thought

Bitcoin does have an advantage compared to fiat currencies because it is made in a limited amount like gold. While printed flat money represents a need that can trigger inflation.

Whereas with Bitcoin because of the limited amount that will be able to hold the inflation rate. Because of the amount of money in circulation rather than transactions.

The practice of printing flat money to provide loans to countries in need is also suspected of cheating. Because there is no gold backup to guarantee it. So central-bank consider printing the money without any effort to get it. But only printing money for free. But they charge interest from the borrower who they do hard work to be able to pay off the debt plus interest on the loan.

And this is where the power of Bitcoin is because it is made in limited quantities. And people who want to get it must do business by mining. Or buying through an exchange so that inflation can be suppressed.

Bitcoin has no particular authority that has a monopoly on money which freely prints money no matter how much it wants.

Are you crypto trader?

Open an account or try Demo account.

Must read

What is Ripple XRP cryptocurrency?

How to buy ethereum cryptocurrency